The Evolution of 3D Printing

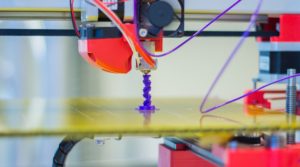

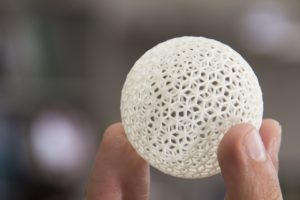

3D printing is the process where a 3D digital model is turned into a solid object. This technology was invented back in 1980 and since then it has been used and has been evolving since then due to the need of the products from it. This technology has made possible to print things or models with different types of materials. Some of the materials include metals, metal alloys, and thermoplastic, thermoplastic composites and ceramic.

3D printers can be categorized in accordance with what they make their model from. They include:

- The printers that form from a photoinduced hardening of resin.

- Printers that prints from a semi-solid or molten form.

- Printers that forms things from powder granules by fusing or binding them.

- Lastly, printers that form things by sticking metal plastic or papers sheets together.

All 3D printers are from the above categories regardless of what they are used for. 3D printing technology is used by different companies for different purpose somewhere they can be used in the production of things like medical devices, home appliances jet engines etc. In the United States industrial-grade 3D printers were one of the highest sold in 2014 and research shows that their usage will have increased to over 40 % by the year 2020 where the industries will abandon most of their old ways of doing things and embrace this technology in their fields.

The 3D technology has brought big changes in various fields and made many things happen. Some of these fields include:

Medical- 3D printing is rapidly expanding in the medical field and will bring a great revolution in the field. Things like organ and tissue fabrication (skin grafting), the creation of implant model and pharmaceutical research are some of the things that 3D technology have made possible in medical fields. It has brought many advantages to the field where it helps in personalization and customization of medical equipment which makes it cost effective and increases the quality and quantity of production.

Manufacturing- 3D production is one of the fastest growing areas in the manufacturing industry. this has helped in lowering the production cost and increasing the quality of the products. Even though the cost of the products that comes from 3D printing might be higher it can be reduced due the flexibility and evolution of the printers where a manufacturing company might start to produce a variety of products with the help of it. Therefore the industrial enterprises should revisit their operations to check what can be done in order to change how things are done using the printers this will help to increase proficiency and the quality of the products that are produced.

Conclusion

3D printing has proved to be one of the useful and transformative tools in the different field. There is an increase of production due availability of resources. Nevertheless, usage of this technology in some areas like medical fields requires being regulated where some of this technology might need some time to evolve.

[zombify_post]

![Kerry Brooks | Bright portraits with colored pencils (2023) Webrip [EN, RU] Kerry Brooks | Bright portraits with colored pencils (2023) Webrip [EN, RU]](http://nullpk.com/wp-content/uploads/2025/05/b55f0d632531f594bbe238a030554742.jpg)

![SUSAN RUBIN | Fundamentals of working with colored pencils (2020) Webrip [EN, RU] SUSAN RUBIN | Fundamentals of working with colored pencils (2020) Webrip [EN, RU]](http://nullpk.com/wp-content/uploads/2025/05/2769564fedf3ec52dcd68756b1865e12.jpg)

Leave a Reply

You must be logged in to post a comment.